What Happened in Q2 2021

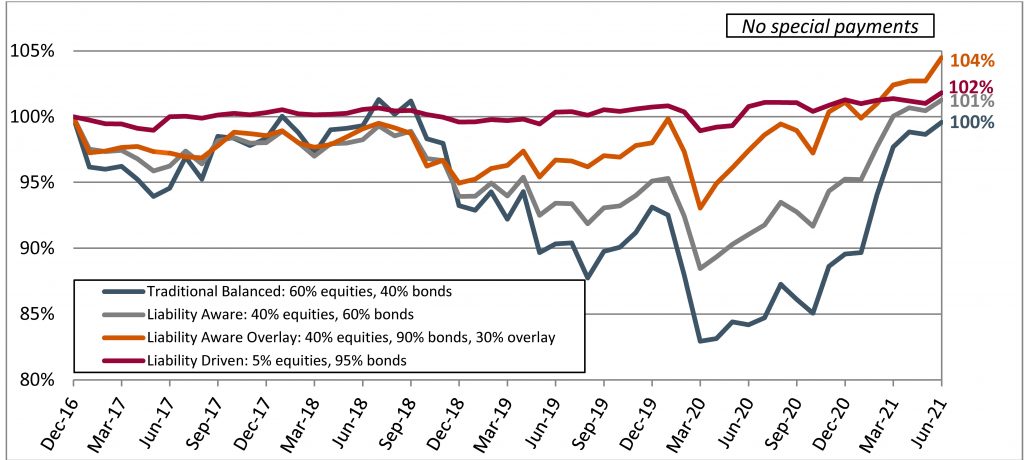

Since the beginning of 2021, the vaccine rollout has helped the markets recover significantly, as most investors have gained confidence. Strong equity returns have helped increase pension plan assets, while the rise in bond yields has caused the pension plan liabilities to decrease. As a result, pension plan funding ratios have improved remarkably since the beginning of the year, generally to above 100%. The “traditional balanced” index had the greatest recovery, while the “Liability Aware” and “Liability Driven” Indices showed smaller improvements. Despite increasing since the beginning of the year, interest rates are still expected to remain low throughout the year.

Table 1 outlines the movements in the PBI Pension Funding Indices based on four asset strategies that vary in the amount of Liability Aware and return-seeking assets embedded in the fund’s asset mix.

Table 1: PBI Canadian Pension Funding Indices Ending June 30, 2021

PBI Canadian Pension Funding Indices

The PBI Canadian Pension Funding Indices illustrates the potential impact of market changes on the going concern Funded Ratio [1] of a Cost Neutral Pension Plan. The indices illustrate how various asset mix strategies would have performed for the Cost Neutral Pension Plan. The Cost Neutral Plan represents the average demographics of PBI’s client database of pension plans (plan duration of 15 years) and where the contributions to fund benefits are equal to the normal cost for the plan; no PfADs, no special payments and no contribution margins are included in determining the indices movements.

[1] A funded ratio shows how a plan’s assets compare to the actuarial assessment of the value of the liabilities. In short, it is the “value of assets” to the “actuarial value of liabilities.” Actuaries generally measure the liabilities in two ways, “going concern” and “solvency.” We have focused on going concern as it is the measure most applicable to our plans.

Click here to download this publication in a printable PDF format:

PBI Canadian Pension Indices

![What Happened in Q2 2021 Since the beginning of 2021, the vaccine rollout has helped the markets recover significantly, as most investors have gained confidence. Strong equity returns have helped […]](https://pbiactuarial.ca/wp-content/uploads/2017/11/logo-full.png)