In just a few years the economic environment has changed dramatically for pension funds, especially multi-employer pension plans (MEPPs). Volatility in the investment markets has taken assets under management on a bit of roller coaster ride. Likewise, the rise in interest rates from dramatic lows to dramatic highs has impacted plans’ existing bond holdings. And yet the capital market outlook tells us that the future looks bright relative to recent times. Many pension plans are facing extraordinary labour force challenges too: the diminishing availability of workers, technological change and, in many industries, secular decline is forcing plan administrators to face up to the possibility of fewer working members paying into the plans and more retired members to support.

How plans deal with this unfamiliar landscape will be key to their performance—indeed, their survival. The following briefly summarizes the key trends and adaptations we are seeing so far.

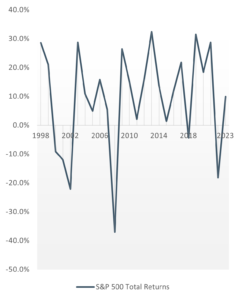

Trend 1: Adapting to Investment Return Volatility

Trend 2: Rising Interest Rates May Reduce Cost

The recent rise in interest rates, by contrast, poses a different challenge for pension plans, but also a potential opportunity. For the past decade rates have been historically low, however, over the last couple of years rates have taken a dramatic swing upwards. Long-term bond rates dropped below 1% in 2020 compared to their current rates of closer to 3.5%. That doesn’t sound like much, but each additional percentage point roughly equates to about a 20% reduction in a plan’s solvency liabilities, with the same types of reductions being felt by members in commuted value calculations. The move in interest rates has dramatically improved the solvency positions of most pension plans, and contrarily, reduced the payout levels to terminating members. Plans that have been waiting to wind up or merge into larger plans are finding the timing favourable as costs to do so approach their lowest levels in years.

Trend 3: Improved Capital Market Outlook

Another potential upside for pension plans lies in the fact that changing market conditions since 2021 have boosted long-term expected rates of return for traditionally invested plans. Today’s capital market outlook suggests that plans may see their expected long-term annual rate of return increase by over 1%, and taken over 30 years, that can make a big difference in a plan’s funding requirements. Many plan administrators are considering raising their discount rates, something that has not been seen in decades. This in turn would reduce the funding pressure in terms of actual contributions required to be remitted to the plan. Alternatively, plans also have the option to hold the discount rate where it is and instead benefit from the resulting increased margin.

Trend 4: Shift to Alternative Assets

One of the ways plans have tried to cope in this changing economic environment is by increasing their allocations to alternative asset classes such as private equity, infrastructure, and real estate, all of which have the potential to reduce volatility while achieving the same investment returns. However, for smaller plans, it may be hard to access these asset classes. In some cases, such plans have partnered or merged with larger public-sector plans to gain exposure to these alternative strategies. Plans still need to consider and assess the impacts of liquidity for these assets and what it means for their plans and although there is reduced volatility, it does not necessarily mean reduced risk.

Trend 5: Attention Being Paid to Changing Labour Forces

The underlying industry of the plan sponsor for a pension plan can play an extremely important role in the health and future of the plan too. Plans in declining industries will mature quicker whereby the ratio of member contributions to benefit payouts, or alternatively ratio of active to inactive members, starts to decline. Maturing pension plans have additional funding restraints that must be considered. But booming industries, such as construction, face problems too. The abundance of work can incite job-hopping by members which can in turn result in workers leaving plans unexpectedly, sometimes triggering costly early retirement benefits. Because of these labour-force challenges, plans are looking ahead by including more demographic modelling analysis than in the past. They are trying to foresee where their member base is going to be 10 or 20 years from now and prepare accordingly.

Trend 6: Increased Communication

Finally, plans face the challenge of communicating all these factors impacting their pension plan, along with how the plan is managing these challenges, with their members. As always, workers want to know where their contributions are going and what value the plan will ultimately bring them. But they don’t want to be inundated with information either. Plans are making use of digital communication tools, graphics, videos, and virtual meetings to get the points across in a more digestible way.

The rapid changes in the economic environment over the past few years are forcing pension plans to rethink their practices and strategies. Pension plans must continually adapt to what the world throws at them. Those that are proactively responsive to the new forces they face should prove resilient and will continue to meet their commitments to members for years to come.

![In just a few years the economic environment has changed dramatically for pension funds, especially multi-employer pension plans (MEPPs). Volatility in the investment markets has taken assets under management on […]](https://pbiactuarial.ca/wp-content/uploads/2017/11/logo-full.png)